The White River Credit Union is here to serve its members. The money you deposit is in turn lent back to friends and neighbors. You can be proud that your deposits are working to help people within your community.

Your money is safe too! All members' deposits are federally insured up to $250,000.00 by the National Credit Union Adminstration (NCUA), an agency of the United States Government. Because of our mission to return all profits to the members, your participation in our cooperative means overall higher dividend rates than are typically available at other institutions.

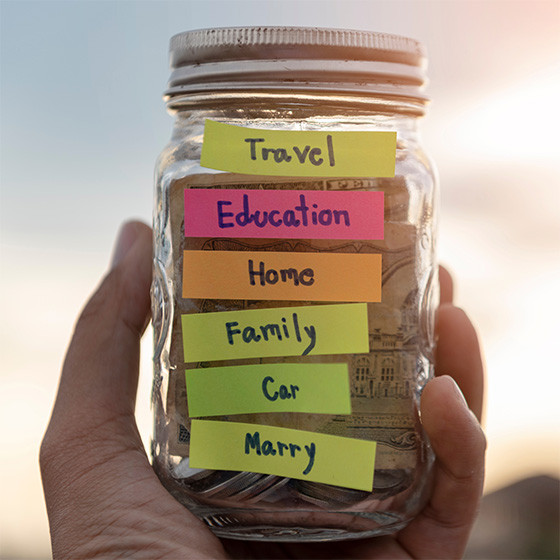

We also offer the convenience of automatic savings via payroll deduction or direct deposit from your employer. This way funds go directly to your savings or checking account. We are currently receiving funds from many employers in our area, so chances are your employer is already participating. Why not begin the easy way to build up that nest egg and save for the holidays or vacation.

Share Savings

To become a member of the White River Credit Union, you must open and maintain a savings account called a Primary Share Account with a minimum balance of $5.00. This is your membership share in the Credit Union. For further information, please refer to the following:

Try our Savings Calculator to create a long-term or short-term savings plan.

Also, we offer the College Savings Calculator to estimate how much you'll need to save each month for college tuition.

Minor Share Savings

Teaching basic money management skills to children is vital. Opening a savings account can help a child learn to save throughout their life. As your child progresses with his/her understanding of money management, other services can be added to their account as they mature. The WRCU offers Youth Share Draft (checking) Accounts, ATM/Debit Cards, Secured Loans and a VISA Credit Card. Please contact us regarding any of these services.

Vacation & Holiday Club Accounts

The WRCU offers two separate club accounts. These accounts are special savings accounts that earn dividends. The Vacation Club disburses on June 1st each year and the Holiday Club disburses on October 1st each year. Interest is forfeited when a withdrawal is made prior to the scheduled disbursement date. These account plans allow you to save for up to twelve months so that you have money available when you need it for summer vacations, winter holidays, or whatever you like.